|

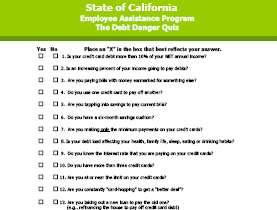

Digital News Report – Does bankruptcy seem like your only financial option? The State of California has a new quiz on their website to help residents determine their best options. The information can help people in other states as well. The form asks you various financial questions.

The inquiry may seem personal but they don’t ask for your name or any real identifiable data. The state asks various questions including:

Is your credit card debt more than 10% of your NET annual income?

Are you taking out a new loan to pay the old one?

The most important question concerns your savings. If you don’t have any savings, and you answered yes to any of the other questions, they give a phone number to call for a free financial consultation (800) 327-0801.

Yes No Place an “X” in the box that best reflects your answer.

1. Is your credit card debt more than 10% of your NET annual income?

2. Is an increasing percent of your income going to pay debts?

3. Are you paying bills with money earmarked for something else?

4. Do you use one credit card to pay off another?

5. Are you tapping into savings to pay current bills?

6. Do you have a six-month savings cushion?

7. Are you making only the minimum payments on your credit cards?

8. Is your debt load affecting your health, family life, sleep, eating or drinking habits?

9. Do you know the interest rate that you are paying on your credit cards?

10. Do you have more than three credit cards?

11. Are you at or near the limit on your credit cards?

12. Are you constantly “card-hopping” to get a “better deal”?

13. Are you taking out a new loan to pay the old one?

(e.g., refinancing the house to pay off credit card debt)

14. Are you unsure about how much you owe?

15. Are you and your spouse / partner honest with each other about your debts?

16. Are you habitually late in paying your bills?

17. Are you considering “debt consolidation”?

18. Have you considered bankruptcy?

19. Have you been threatened with: Repossession of your car Cancellation of your credit cards Bill collection Other financial action

By: Tina Brown

Business Writer