|

Digital News Report – The Dow squeaked up to near 11,000 Friday but investors are worried that the arbitrary marker may be a distraction. There is a concern that the light trading could mean the rally will be over soon.

You don’t usually see advances without volume, according to Louise Yamada, an analyst in New York. There was a midweek hiccup when investors worried about the Greek debt crisis, but Thursday and Friday were higher.

Alcoa and Constellation Brands were big movers on the NYSE. A JP-Morgan analyst worried that lower metal prices could hurt the company in the short term. This could affect the bottom line despite their cost cutting measures.

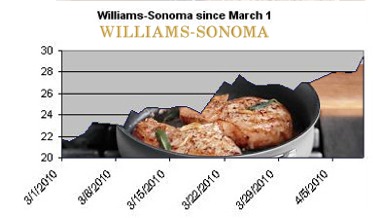

Williams Sonoma was also higher today as the economy is poised for a turnaround. Shares in the home specialty chain were up 1.36 to 29.43 (4.85%).

Chevron Corp issued an update saying that their first quarter earnings will likely be better than the last quarter. Shares closed 79.50 up 1.84 (2.37%).

Constellation Brands Inc. was down 42 cents to $16.43 after the company said low price wine sales remain weak and the higher priced beers were selling slower. Constellation announced a share repurchase program today.

By: Tina Brown