|

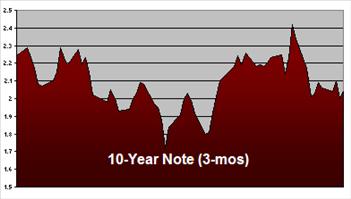

Digital News Report – Mortgage refinance rates were lower this week with Bank of America, Citibank, Chase, and PNC making some changes (see chart).

The U.S. Treasury 10-year note rate increased four basis points to 2.04 percent on Thursday, however for the week the yield was down two basis points. Turmoil in Europe pushed capital markets into Treasuries forcing down the yield rates prompting lenders to make adjustments to their mortgage rates.

Chase kept their conventional 30-year rate steady on Thursday but over the last 5-business days the bank has lowered their rate several basis points.

Citibank also lowered their 30-year fixed rate mortgage (FRM) this week down to 4.40 percent.

The rates will vary according to the location of the house and the credit score of the borrower. Not all loans will be available in all states either. FHA and VA loan rates will also be different.

PNC lowered their 30-year rate to 4.14 percent this week. The bank also offers 15-year refinance loans starting at 3.41 percent.

Finally, Bank of America lowered their 30-year mortgage refinance rate to 4.412 percent this week. BofA is also offering 5-year (30-year term) adjustable rate mortgages (ARM) for 3.169 percent.

The average 30-year fixed refinance rate was 4.35 percent this week.

By: Tim Edwards

| REFINANCE RATES | |||||

| 11/12/2011 | Citibank | PNC | Bankf America | Chase Bank | Average |

| 30-Year Fixed | 4.40% | 4.14% | 4.412% | 4.35% | 4.35% |

| 15-Year Fixed | 3.90% | 3.41% | 3.873% | 3.65% | 3.66% |

| 5-Year Adjustable | NA | NA | 3.169% | 3.05% | 3.11% |