| Listen to our audio presentation: Stock Market Timing |

Germany’s Finance Minister Christian Lindner has firmly rejected a proposal by Mario Draghi, the former head of the European Central Bank, calling for joint EU borrowing to fund investments. According to Lindner, who expressed his concerns in an interview with Politico, Germany will not support the idea, as it raises “democratic and fiscal problems.” The proposal, outlined in Draghi’s report on the future of EU competitiveness, suggests that the EU needs to invest €800 billion annually until 2030, covering crucial sectors like energy, transport, and green technology.

- Germany’s Finance Minister Christian Lindner rejected Mario Draghi’s proposal for joint EU borrowing, citing democratic and fiscal risks.

- Draghi’s report calls for €800 billion in annual investments until 2030 to boost EU competitiveness, particularly in energy and transport.

- The proposed borrowing would support infrastructure like cross-border energy grids and electric vehicle charging networks.

- European Commission President Ursula von der Leyen supports the plan, while Lindner argues the real issue is bureaucratic hurdles, not subsidies.

- The report warns the EU risks being left behind by the US and China without urgent action, but gathering political support for joint borrowing remains challenging.

Draghi’s report, which has been widely anticipated, argues that large-scale public funding could spur private investment, a notion strongly supported by European Commission President Ursula von der Leyen. However, Lindner, whose party has struggled in recent elections, contends that joint borrowing would only increase government debt without guaranteeing growth. He emphasized that the real challenge lies in overcoming bureaucratic hurdles and reforming Europe’s economic policies rather than relying on additional subsidies.

The proposed investment package includes €300 billion for the energy sector, with the aim of expanding cross-border energy grids and supporting the growing cleantech industry. Another €150 billion would go toward improving transport infrastructure, including the development of charging networks for electric vehicles. This is especially significant given the EU’s goal to transition to cleaner transportation methods, while European carmakers face increased competition from China.

As The Economist highlighted, Draghi’s recommendations are part of a larger effort to address Europe’s ongoing economic challenges. The report suggests that Europe risks falling behind the US and China without swift and comprehensive action, particularly in innovation and technology. Draghi was explicit in stating that the EU “largely missed out on the digital revolution” and warned that it could face an “existential challenge” if further investments are not made.

Yet, the proposal for joint borrowing has stirred considerable controversy, particularly among countries like Germany, which have traditionally been cautious about taking on additional debt. Lindner’s opposition underscores the difficulty the EU faces in reaching a consensus on financing large-scale projects that require collective responsibility.

According to the BBC, the Draghi report underscores the need for unprecedented investment, amounting to 5% of the EU’s GDP, to avoid economic stagnation. The report also stresses the necessity of expanding joint borrowing to fund these investments, a solution that is not legally binding but has sparked debate across EU capitals. Draghi stressed the urgency of the situation, stating that the EU faces its most severe challenge since the Cold War.

Although the report has drawn praise from some quarters, including tech leader Elon Musk, others warn that gathering political support for such a bold plan could prove challenging. As noted by a BBC analysis, Draghi’s proposals would require strong cooperation between EU member states—something that has historically been difficult to achieve on such a scale.

In the coming months, EU leaders will need to weigh their options carefully. They must decide whether to heed Draghi’s advice and embrace a unified financial strategy, or pursue alternative methods of funding the significant investments needed to keep Europe competitive on the global stage.

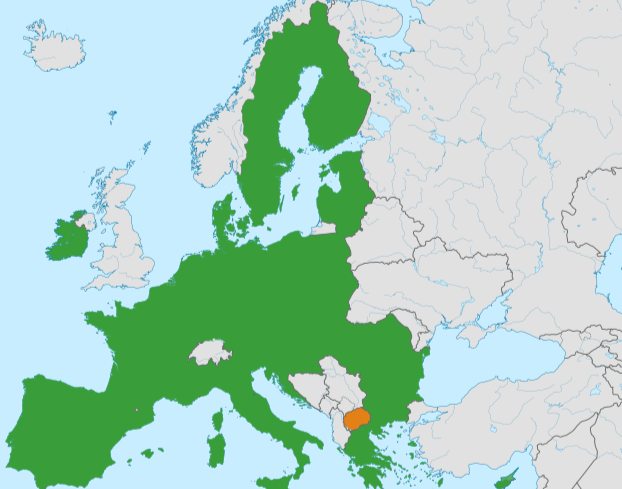

The UK is no longer part of the European Union (EU) due to the decision to leave the bloc following a 2016 referendum, commonly known as “Brexit.” The official exit occurred on January 31, 2020, after which the UK entered a transition period that ended on December 31, 2020. During this time, the UK negotiated new trade and cooperation agreements with the EU.

The decision to leave the EU was driven by various factors, including concerns over national sovereignty, immigration control, and the desire to reclaim legal authority over domestic policies, which many felt were influenced by EU rules and regulations.

Despite its exit, the UK remains connected to the EU in several ways:

- Trade: The UK and EU signed the EU-UK Trade and Cooperation Agreement (TCA), which regulates their economic relationship. While it allows for tariff-free trade in goods, there are still customs checks, regulatory barriers, and restrictions on services.

- Security and Data Sharing: The UK and EU still cooperate on security matters, though the UK is no longer part of the EU’s law enforcement agencies like Europol. They continue sharing some security data to combat crime and terrorism.

- Travel and Mobility: UK citizens no longer have automatic rights to live and work in EU countries, but short-term visa-free travel is still allowed. However, freedom of movement for longer stays or work has been restricted.

- Northern Ireland Protocol: Northern Ireland remains in the EU’s single market for goods to avoid a hard border with the Republic of Ireland, an EU member. This arrangement keeps some EU customs rules in effect in Northern Ireland, which creates some trade friction between Northern Ireland and the rest of the UK.

- Research and Education: The UK has left the Erasmus student exchange program but still participates in some EU science and research initiatives, such as the Horizon Europe program, under different terms.

While the UK is no longer a full member of the EU, these areas of cooperation show that the UK and EU maintain important economic, security, and regulatory links. However, they are governed by a more distant and formal relationship than when the UK was part of the bloc.

The central banks of the UK and the EU—namely the Bank of England (BoE) and the European Central Bank (ECB)—both play crucial roles in their respective economies, but they differ in structure, mandates, and the economies they serve. Here’s a comparison between them:

1. Mandate and Goals

- Bank of England (BoE): The BoE has a dual mandate focusing on:

- Price stability: Its primary goal is to maintain inflation at 2%.

- Support economic growth and employment: The BoE has more flexibility in adjusting policies to support employment and economic growth, especially during crises.

- European Central Bank (ECB): The ECB’s primary mandate is more singular:

- Price stability: Its main goal is to keep inflation in the eurozone close to, but below, 2%.

- Unlike the BoE, the ECB places less emphasis on employment or economic growth, although it indirectly supports these objectives by maintaining stable prices.

2. Structure and Governance

- Bank of England: The BoE is the central bank for a single country—the UK. It is governed by its Monetary Policy Committee (MPC), which makes key decisions regarding interest rates and quantitative easing.

- The BoE has full control over monetary policy for the UK, meaning it can adjust interest rates and engage in independent policy moves tailored to the UK’s economic needs.

- European Central Bank: The ECB is the central bank for the entire eurozone, a group of 20 countries (as of 2024) that use the euro as their currency. It is governed by:

- Governing Council: Made up of the heads of the national central banks of eurozone countries and the six members of the ECB’s Executive Board.

- The ECB has to consider the economic conditions of all eurozone member states, meaning its policies are often a compromise to meet the diverse needs of different countries.

3. Monetary Policy Tools

- Bank of England:

- The BoE sets the Bank Rate (the interest rate) to influence inflation and economic growth.

- It also uses quantitative easing (QE), where it buys government bonds to inject money into the economy.

- The BoE is more flexible in adjusting its policies, often responding quickly to domestic economic conditions.

- European Central Bank:

- The ECB sets the refinancing rate, which influences interest rates across the eurozone.

- It also uses QE and other tools like targeted long-term refinancing operations (TLTROs) to provide liquidity to banks.

- However, given the multiple countries involved, ECB policy often faces delays or compromises, as it has to account for economic conditions in both stronger economies (like Germany) and weaker ones (like Greece).

4. Independence

- Bank of England: The BoE is fully independent in setting monetary policy since 1997. The government can influence policy only through broad economic strategies, but it cannot directly control interest rates or other key decisions.

- European Central Bank: The ECB is also highly independent, operating without direct political interference from individual member states. However, its decision-making must account for the economic diversity of the eurozone, which can make it slower to act compared to the BoE.

5. Scope and Currency

- Bank of England: Manages monetary policy for a single country—the UK—and its currency, the British pound sterling (GBP).

- European Central Bank: Oversees monetary policy for 20 countries that use the euro (EUR). This means its policies must account for economic disparities between stronger economies like Germany and weaker ones like Italy or Spain.

6. Crisis Management

- Bank of England: The BoE was quick to respond to the 2008 financial crisis and the 2020 COVID-19 pandemic, cutting rates and introducing large-scale QE to support the UK economy. Its independence allows for rapid and targeted interventions.

- European Central Bank: The ECB has faced more complex challenges, particularly during the eurozone debt crisis (2010-2015). Its actions are often slower due to the need to balance the interests of multiple member states. However, the ECB took significant steps in recent years, such as Mario Draghi’s famous “whatever it takes” commitment to save the euro, demonstrating the ECB’s evolving role.

Conclusion

- The Bank of England operates with more flexibility, tailoring its monetary policy to the UK’s specific economic conditions. It is relatively quick in responding to domestic issues, given it focuses on a single economy.

- The European Central Bank, on the other hand, manages a much larger and more diverse economic region. Its policies tend to be more cautious and compromise-based, considering the wide range of economic conditions across eurozone countries. However, this broader scope also allows the ECB to wield significant influence over the global economy.

While both central banks focus on maintaining price stability, the BoE has more freedom to address employment and economic growth, while the ECB must navigate the complexities of a multi-country bloc with diverse needs.

The Swiss National Bank (SNB) is the central bank of Switzerland, responsible for overseeing the country’s monetary policy, maintaining financial stability, and ensuring the smooth functioning of its financial system. Here’s an overview of the SNB’s key functions, structure, and unique role in the global financial landscape.

Mandate and Goals

The SNB’s primary mandate is to ensure price stability, with the aim of preventing both inflation and deflation, which could destabilize the Swiss economy. However, unlike many other central banks, the SNB has a more explicit dual focus:

- Price stability: Maintaining stable prices is crucial to supporting sustainable economic growth and protecting the purchasing power of Swiss citizens.

- Economic stability: The SNB also seeks to support favorable economic conditions, intervening when necessary to maintain financial and economic stability.

Monetary Policy Tools

To achieve these goals, the Swiss National Bank uses several key monetary policy tools:

- Interest Rates: The SNB sets a policy rate, which influences short-term interest rates in Switzerland. Since the 2008 global financial crisis, Switzerland has been known for maintaining negative interest rates to combat deflation and maintain price stability.

- Foreign Exchange Intervention: Switzerland’s economy is heavily dependent on exports, and the SNB actively intervenes in currency markets to prevent excessive appreciation of the Swiss franc (CHF), which is seen as a “safe haven” currency. This intervention helps protect Swiss exporters by preventing the franc from becoming too expensive.

- Balance Sheet Management: The SNB holds significant foreign currency reserves and engages in large-scale asset purchases to stabilize the Swiss franc. These reserves are among the largest in the world relative to the size of Switzerland’s economy.

Structure and Governance

The SNB operates as an independent institution, free from political interference, but it is structured differently from other central banks:

- Public and Private Ownership: Uniquely, the SNB is a corporation that is partly owned by public entities (the cantons of Switzerland and Swiss public institutions) as well as private shareholders. However, the government has no influence over its monetary policy.

- Governing Board: The SNB is governed by a three-member Governing Board, which makes decisions on monetary policy. The members are appointed by the Swiss Federal Council, ensuring that the bank’s leadership remains accountable to national interests while maintaining operational independence.

Swiss Franc as a Safe Haven

One of the most notable aspects of the SNB’s role is its management of the Swiss franc (CHF), which is widely regarded as one of the world’s safest and most stable currencies. This safe-haven status makes the franc attractive to investors, especially during global economic uncertainty. As a result, the SNB frequently intervenes in foreign exchange markets to weaken the franc and prevent it from appreciating too much, which could hurt Swiss exports and tourism.

Negative Interest Rates

Since 2015, the SNB has maintained negative interest rates to deter capital inflows that strengthen the franc and to stimulate economic activity. This policy is aimed at encouraging banks to lend more and depositors to spend or invest their money, rather than hoarding cash. While controversial, it has been effective in preventing deflation and supporting economic growth in a low-inflation environment.

Foreign Currency Reserves

The SNB holds massive foreign currency reserves, a direct result of its foreign exchange interventions. These reserves are used to manage the value of the Swiss franc and are invested in various international assets, including government bonds and equities. The size of these reserves gives the SNB considerable financial power, but it also exposes the bank to risks from fluctuations in global financial markets.

Role in Financial Stability

The SNB also plays a crucial role in maintaining financial stability in Switzerland. It works closely with Swiss regulatory authorities to monitor risks in the banking sector, particularly focusing on systemic risks that could threaten the broader financial system. Switzerland’s banking sector, home to global giants like UBS and Credit Suisse (prior to its merger with UBS), is a vital part of its economy, making the SNB’s oversight crucial for global financial stability.

International Cooperation

Despite Switzerland not being a member of the European Union (EU) or the eurozone, the SNB collaborates closely with other central banks, such as the European Central Bank (ECB) and the Federal Reserve. These relationships are critical during times of financial stress, such as the 2008 global financial crisis and the COVID-19 pandemic, when coordinated international monetary policies help stabilize global markets.

Independence and Accountability

Although the SNB is independent in its decision-making, it is accountable to the Swiss public and government. The bank publishes reports on its monetary policy and regularly informs the Swiss Parliament about its activities. Additionally, the SNB’s profits are distributed to the Swiss government and the cantons, ensuring that the bank’s activities contribute to the national budget.

Conclusion

The Swiss National Bank is unique among central banks, balancing its independent monetary policy with the needs of Switzerland’s export-driven economy and the pressures of managing a global safe-haven currency. Its interventions in foreign exchange markets and use of negative interest rates make it a distinctive player in global finance. Through careful management of the Swiss franc and a focus on price and financial stability, the SNB remains a key pillar of Switzerland’s economic success.